A New Platform

For Unlisted Assets

Introducing a distributed ledge based registry platform to manage, and transact private assets

Next Generation

Asset Administration

BlockWrap is the next generation registry administration platform for unlisted investment funds, private assets and corporate equity. Built locally using distributed ledger technology, it frees issuers and fund administrators from surrendering their data to inflexible and expensive third-party services. Investors manage their private holdings from all issuers through a secure tokenised wallet.

Registry Management

Plus Much More

BlockWrap incorporates traditional registry functions including corporate actions with integrated processes for online fund applications and redemptions through its investor portal. Investor management of credentials and documents creates a seamless, efficient process for satisfying the compliance requirements of any issuer on the platform.

BlockWrap was established by Australian shareholders with long experience of the local FinTech and investment environment. With the platform now entering production we are confident our features and technology can be a powerful and disruptive tool for Australian unlisted investment funds and their investors.

Comprehensive registry management. Wide range of transaction types. Unlimited number of funds and other assets.

Built on a widely used open distributed ledger platform. A permissioned secure private network.

Digital wallet holding asset tokens from all applicable issuers. Stored compliance details eliminate friction with new assets.

BlockWrap Advantages

Unlock Efficiency, Security, and Growth for Your Unlisted Investments

Eliminate complex, expensive third-party registries. BlockWrap places full control of data securely back into the hands of issuers, drastically simplifying fund administration, reducing overheads, and boosting operational efficiency.

Leverage blockchain's inherent security and immutability. BlockWrap ensures trust through transparent, auditable records, reducing risk. Compliance details are transparent to issuer and investor.

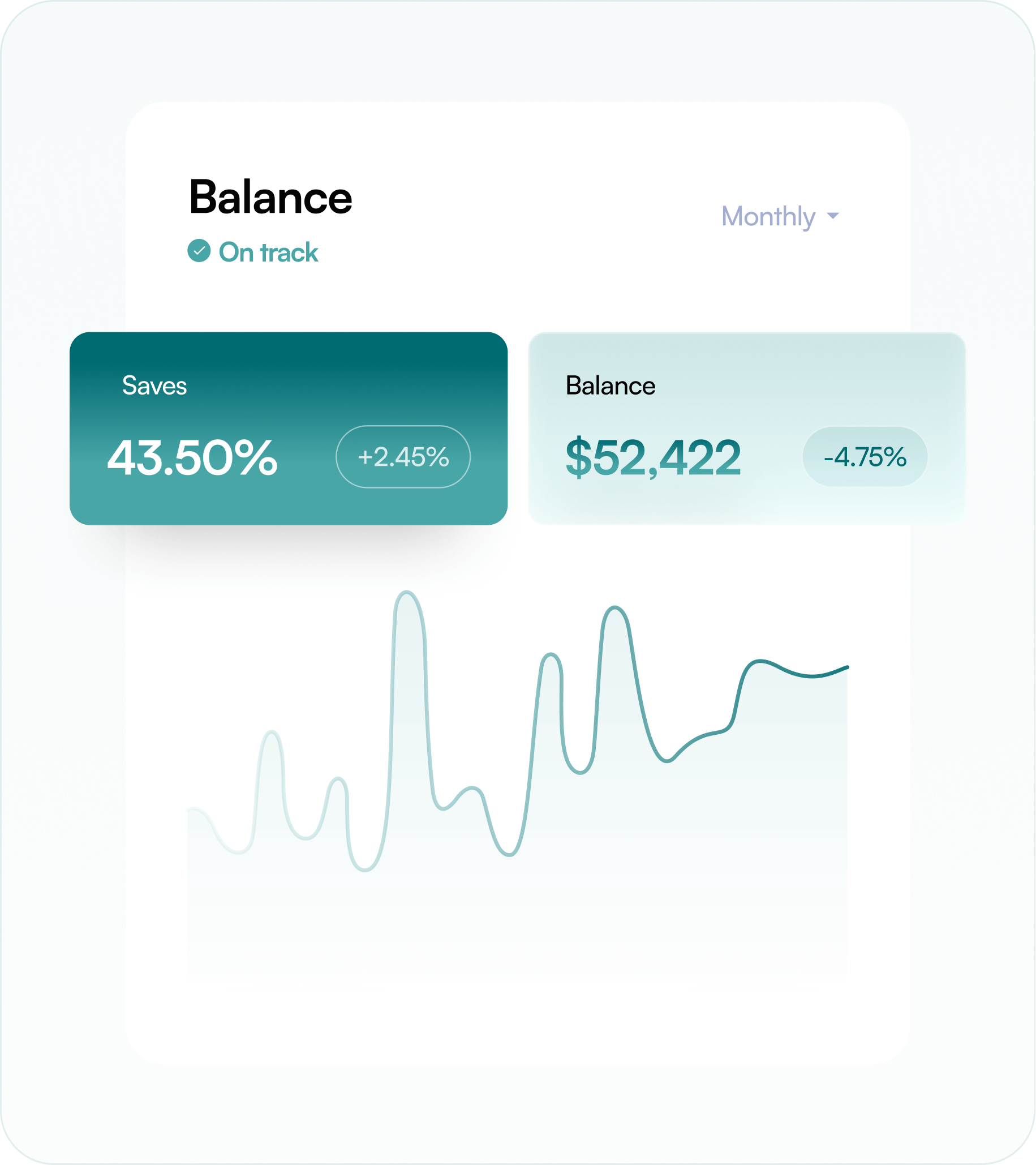

Provide investors with a seamless, secure, and intuitive platform. With BlockWrap's tokenized wallets, investors can easily manage holdings, access consolidated reports, and effortlessly participate in investment opportunities, all from one central, secure location.

Are You Ready To Explore

The Future Of Asset Management

Discover how BlockWrap can revolutionise your investment fund operations. Contact us to schedule a demo or learn more about how our innovative platform can benefit your business.

Administer cryptocurrencies, tokenized assets, and digital securities with real-time monitoring, smart contract automation.

Manage private investments, venture capital, and direct equity deals with transparent reporting and automated compliance workflows.

Oversee diversified property assets, from commercial real estate to residential units, with streamlined valuation tracking management.